september child tax credit payment not issued

If you claimed your child on a 2019 or 2020 tax return the IRS may have automatically issued you advance CTC payments. If you get both Child Tax Credit and Working Tax Credit you will receive a Cost of Living Payment for Child Tax Credit only.

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Cbs News

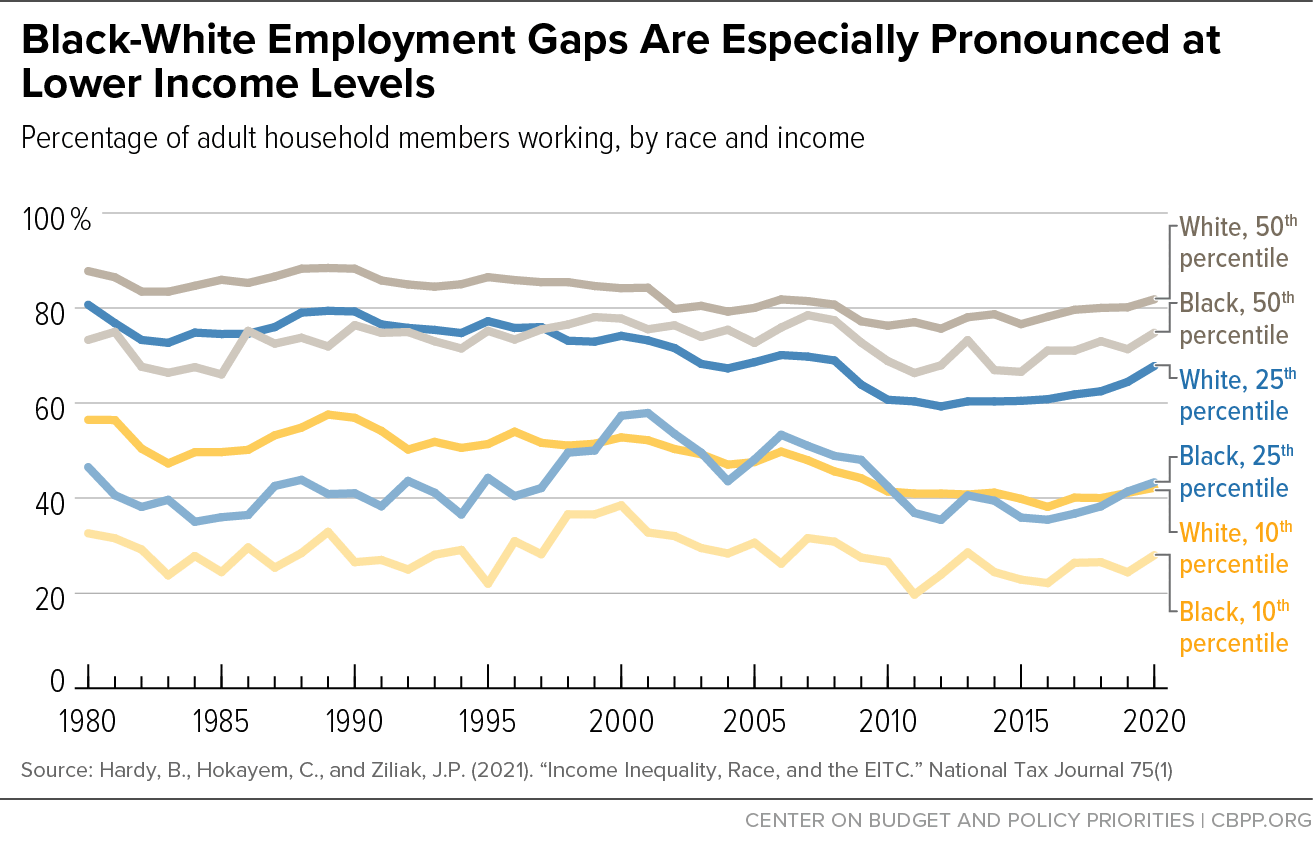

The United States federal earned income tax credit or earned income credit EITC or EIC is a refundable tax credit for low- to moderate-income working individuals and couples particularly those with children.

. Use the Child Tax Credit Update Portal CTC UP to opt-out of advance payments. Families Will Soon Receive Their December Advance Child Tax Credit Payment. What do I do.

The tax credit for paid sick leave wages is equal to the sick leave wages paid for COVID-19 related reasons for up to two weeks 80 hours limited to 511 per day and. Been a California resident on the date payment is issued. IR-2022-106 Face-to-face IRS help without an appointment available during special Saturday opening on May 14 IR-2022-105 IRS provides guidance for residents of Puerto Rico to claim the Child Tax Credit IR-2022-91 Taxpayers who owe and missed the April 18 filing deadline should file now to limit penalties and interest.

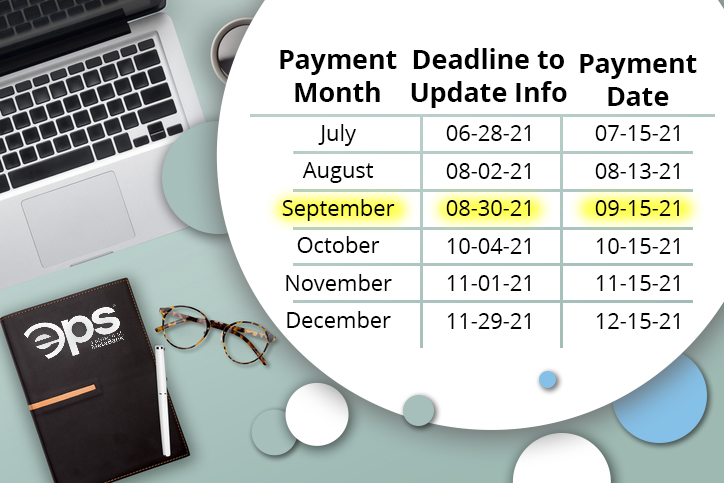

Advance Child Tax Credit payments per the IRS In September the IRS successfully delivered a third monthly round of approximately 36 million Child Tax Credit payments totaling more than 15 billion. California lawmakers have proposed a child tax credit bill to provide relief to low-income families according to KABC. If you only receive Tax Credits you will get the first payment of 326.

For a person or couple to claim one or. The child tax credit for tax years 2022 and onward will revert back to pre-2021 rules. The tax credits are refundable which means that the employer is entitled to payment of the full amount of the credits if it exceeds the employers share of the Medicare tax.

Please refer to the guidance notes 1Mb for help with documentation requirements. Been a California resident for more than half of the 2020 tax year. Those Not Receiving.

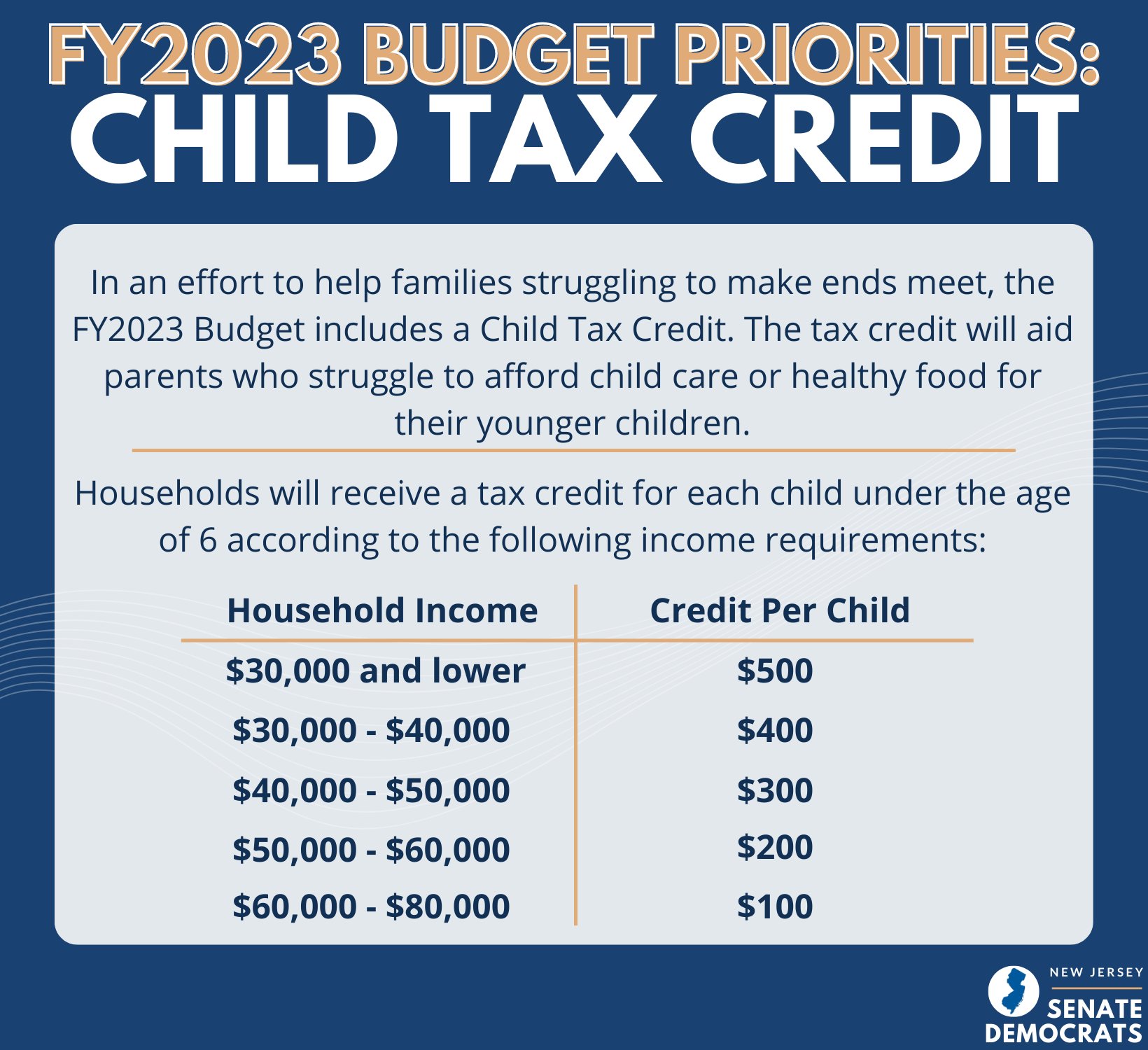

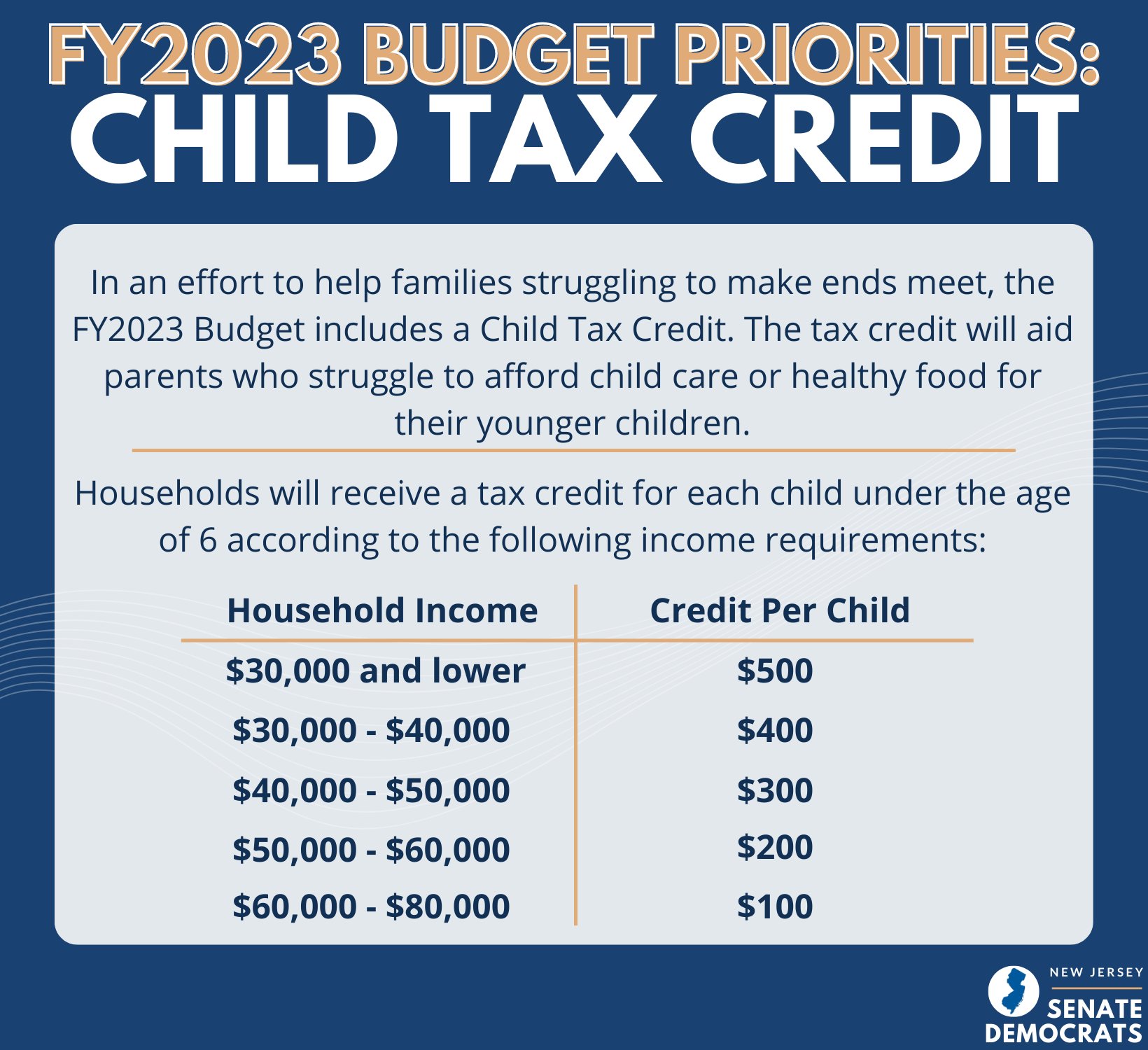

Getty ImagesScience Photo LibrarySCU September -. You may also qualify for free. The credit would be a one-time payment of 2000 per child for families that earn 30000 or less per year.

Child Tax Credits only CTC with an annual income of less than 17005 Working Tax Credit and Child Tax Credit with an annual income of less than 17005 Support under Part VI of the Immigration and Asylum Act 1999. A dependent is a qualifying child or qualifying relative. Not been claimed as a dependent by another taxpayer.

Update on Sept. The bill AB 2589 would use the states unprecedented 68billion budget surplus. Not too late to claim the Child Tax.

I am receiving the Child Tax Credit advanced payments but my child does not live with me in 2021. Low income adults with no children are eligible. Given the new components of this program the IRS continues to work hard to make improvements and deliver payments timely.

People receiving Tax Credits will be paid 326 to help with the cost of living in September Image. The amount of EITC benefit depends on a recipients income and number of children. Your future advance payments.

If you get Tax Credits from HMRC and a low income benefit from DWP you will get a Cost of Living Payment from DWP only starting from July 14. Go to FTB Publication 1540 for more information about a qualifying child and qualifying relative.

Child Tax Credit Has A Critical Role In Helping Families Maintain Economic Stability Center On Budget And Policy Priorities

Child Tax Credit 2022 Update Deadline Approaching To Claim Direct Payments Up To 750 Are You Eligible For The Cash The Us Sun

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

Child Tax Credit Has A Critical Role In Helping Families Maintain Economic Stability Center On Budget And Policy Priorities

Tennessee Department Of Human Services

Child Tax Credit 2022 Update Deadline Approaching To Claim Direct Payments Up To 750 Are You Eligible For The Cash The Us Sun

Senate President Nick Scutari Senpresscutari Twitter

3 11 13 Employment Tax Returns Internal Revenue Service

2021 Child Tax Credit Stimulus And Advance H R Block

3 11 13 Employment Tax Returns Internal Revenue Service

Eps Powered By Pathward The Child Tax Credit Payments Pros And Cons To Think About

How Does Child Tax Credit Work For Divorced Parents And Other Non Traditional Families The Washington Post

Child Tax Credit 2022 Update Deadline Approaching To Claim Direct Payments Up To 750 Are You Eligible For The Cash The Us Sun

Sustainable Building Tax Credit Sbtc Energy Conservation And Management

Updated How Employers Can Claim Arpa Cobra Subsidy Tax Credits Sequoia

/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)